What is Moneyfarm

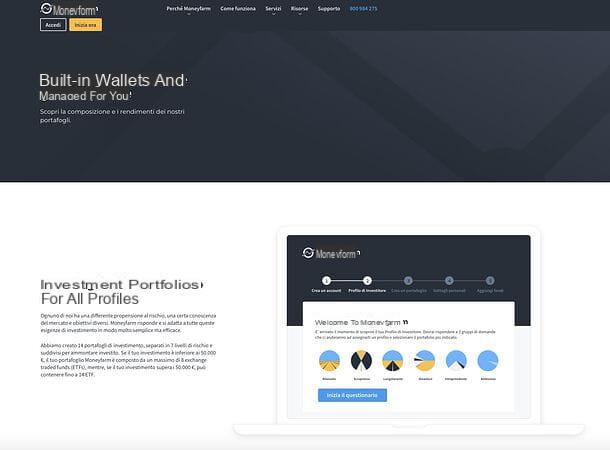

Let's start with the basics, namely from what is Moneyfarm and what it does. As already mentioned at the opening of the post, Moneyfarm is an independent financial consultancy company founded in the city in 2011 and which today operates in the city, United Kingdom and Germany according to the regulations of the Financial Conduct Authority and the supervision, in the city, of Consob. It has been awarded for 4 consecutive years by in your languagen savers with the title of Best Independent Consulting Service in town and the reasons, as already mentioned, are to be found in its ease of use, its effectiveness in reducing risks and its flexibility.

Moneyfarm defines the investor's profile, designs an investment plan tailored to his objectives (based on ETF portfolios) and manages it over time, with the aim of preserving its value and seizing the opportunities offered by the market. From a practical point of view, the service works in a very simple way: after registration, the investor must fill in a online questionnaire and define your needs, in order to choose one of the 7 risk profiles available (eg. Relaxed, Scrupulous, Far-sighted, Dynamic o Enterprising).

Once the risk profile has been chosen, the definition of the personalized investment plan, which takes into account the risk attitude of the person, the time for which he wants to keep the invested capital and the amount of the latter (in relation to the total capital) and the investment objective itself.

Once the account activation has been obtained (following all the required financial checks), the investor can make a initial investment of at least 5.000 euros and / or define a Accumulation plan (PAC) with monthly contribution.

The investment process is in charge of Moneyfarm which, through its team of experts in Asset Allocation, deals with the purchase of the securities and the management of the investment, carrying out periodic rebalancing to adapt the investment to changing market conditions . Behind the service, in short, there are people in flesh and blood and not automated systems.

The customer can monitor everything through his personal area, accessible via the Web or via smartphone app, or contact a dedicated consultant, who is at his disposal for any support needs.

It is important to point out that there are no constraints: regardless of the time horizon defined during the creation of the investment, the investor always has the right to disinvest the capital or part of it at any time and without costs or penalties.

Another key thing to highlight is that Moneyfarm offers one independent advice: it is, in fact, one of the few companies in the city that does not receive commissions based on the instruments it suggests to buy, but only has management costs. For more information, I leave you directly to the Moneyfarm website (and the rest of this article).

Requirements for using Moneyfarm

Before getting into the tutorial and finding out how to create your Moneyfarm account, it will surely be useful to know what the requirements to use the service and successfully complete the registration to it.

- A capital of at least 5.000 euros: minimum amount needed to invest in Moneyfarm.

- A current account in your name: required during registration, during which identity verification is requested via IBAN. Furthermore, providing your account allows you to take advantage of the Direct Debit function, with which Moneyfarm will be authorized to transfer liquidity from the selected current account to the Moneyfarm account.

- Photos of a valid ID: to complete the registration procedure you are asked to send front / back photos of a document of your choice between identity card, driving license or passport, plus the tax code.

For the rest, all you need is a computer or a smartphone and an Internet connection: to open your account, in fact, you do not have to physically go anywhere or send paper documents. It is all done in a matter of minutes directly online.

Moneyfarm costs

Other information that will surely be useful before registering with Moneyfarm are those relating to Costi that you will have to support.

Well, know that Moneyfarm does not present no opening costs, no negotiation fees e no constraints. This, put simply, means that you can open and deposit money into your Moneyfarm account at no cost (subsequent payments will also be free); carry out the recommended transactions without additional costs (commissions are already included in the Moneyfarm subscription) and that you can withdraw or unsubscribe from the service whenever you want, at no additional cost.

The only costs to be incurred are those relating to the Moneyfarm commission, which is charged on a monthly basis and varies according to the invested capital. For example, the annual fee for invested capital of between € 5.000 and € 15.000 amounts to 1,0%; for a capital of 15.000 euros and less than 200.000 euros at 0,6%; for a capital of 200.000 euros and less than 500.000 euros to 0,4%, while for a capital starting from 500.000 euros it is 0,3%.

Commissions do not include VAT, equal to 22% of the monthly invoice, the average cost of funds (0,26%) and the annual bid-ask spread, up to 0,07%. If you want more information and want to estimate the exact costs related to the type of investment you intend to make, visit this Moneyfarm page.

How to sign up for Moneyfarm

Now that you know what Moneyfarm is, you are ready to create your account and invest your money. Then connect to the home page of the service and click on the button Sign up now, to start the registration process.

The process is divided into four phases: the Signup, in which you must provide the basic information for creating the account (email address, password and mobile number); the delineation of the Investor Profile, through which to identify the investment profile and define the range of portfolios most appropriate to one's needs; the Questionnaire, through which to provide Moneyfarm with personal information useful for creating the account and, finally, the Portfolio Preview, which allows you to create your own wallet, viewing a detailed preview.

The account can be created from a PC, through the official Moneyfarm website, or from smartphones and tablets, by downloading the Moneyfarm app for Android and iOS. To write the tutorial, I chose to follow the procedure from a PC. In any case, the steps to be taken are more or less the same even from mobile, so even acting from a smartphone or tablet you will not find it difficult to follow my instructions. For all the details, read on: everything is explained below.

Signup

As just mentioned, the Signup of Moneyfarm consists in filling out a form with the basic information for creating the account: email address, Password e cellphone number.

After providing these data, check the box relating toacceptance of terms and conditions and press pulsating Create an account, below, to move on to the next phase: the definition of the Investor Profile.

Investor Profile

The phase of choosing the Investor Profile begins with a page where all the profiles available on Moneyfarm are listed: Relaxed, Scrupulous, Far-sighted, Dynamic, Enterprising e Ambitious. To find the one that suits you best, you need to click on the button Continue (below) and follow the on-screen instructions.

For starters, start filling out the form for yours financial situation, in which to indicate yours main source of income, your net annual income, how much do you save per month, how much is your assets (excluding the first house), what is your main investment objective and yours date of birth. Once you have entered all the information, click on the button Continue.

At this point, you have to tell more about your experience with investments and financial instruments: respond, then, to the statements you see on the screen (eg. I find ETFs a great way to diversify investments while reducing risk e I make frequent purchases or sales of financial products such as ETFs, mutual funds, stocks or bonds) indicating if I know ofagreement o disagree with them, through the appropriate boxes. Then indicate yours educational level and go ahead by pressing the button Continue.

Now you need to help Moneyfarm a identify the risk profile that best suits you: To do this, use the boxes displayed on the screen to indicate if you areagreement o disagree with the various statements that are proposed to you (eg. Taking risks doesn't scare me and it's the only way to have new opportunities e In the event of a negative market trend, I am willing to bear even significant losses), then click on the button Discover your Investor Profile, to view a description of the Investor Profile that best suits your characteristics and analyze it in detail.

I point out that, using the drop-down menu Amount invested, you can choose an amount to invest and view a series of statistics (eg. Short-term Government Cash and Bonds, Developed Countries Government Bonds, Developed Countries Equity e Liquid assets) and graphs (eg. Past returns) linked to the latter, based on the Investor Profile that was designed based on your previous answers.

If the Investor Profile suggested by Moneyfarm convinces you, click on the button Confirm the profile and continue, to continue; otherwise go back to the top of the page, click on the link change your answers and modify the answers you gave to the previous questionnaires to also modify the Investor Profile suggested by Moneyfarm.

Questionnaire

Once you have chosen the most suitable Investor Profile for you, you need to fill in a series of questionnaires with your personal data, necessary to correctly complete the account opening procedure.

The first module concerns personal and basic data, such as name and surname, sex of belonging, birth place, tax residence, fiscal Code, cellphone number e residence address: once all the fields have been filled in, click on the button Continue located at the bottom, to move forward.

Now provide theIBAN of a bank account in your name and press the button Continue. Then fill out the form relating toanti-money laundering, indicating the type of profession that you do, yours net annual income bracket, communicating you are a politically exposed person and l 'origin of your assets. Once this is done, press the button once again Continue.

At this point, you need to choose a document to use to verify your identity between identity card, license e passport. Then click on the two links Upload document to upload, respectively, a photo of the front and a photo of the back of the chosen document.

Photos must be of a valid document; they must be legible, without reflections and with four fully visible corners. The uploaded file format must be PDF, JPG, PNG o TIFF and the dimensions must not exceed 5MB.

Once the two photos have been uploaded, fill out the form below with the requested information (eg. document number, place of issue, issuing date e Expiration date, as regards the identity card) and click on the button Continue.

Afterward, upload a photo of yours fiscal Code (or health card) following the same procedure seen for the identity document and click on the button again Continue.

Now take a look at the screen where the Moneyfarm fees, press again Continue and run the verify your phone number: to do this, type yours cellphone number in the appropriate text field, click on the button Confirmation and type il code of confirmation that you will receive within a few seconds via SMS.

Once this step has been passed, you must view and accept all the documentation relating to the advanced electronic signature: read, therefore, the documentation on the screen, check the box relating toacceptance of terms and conditions of the service, type the Password of your Moneyfarm account in the appropriate text field and click on the button Request OTP. You will then receive a confirmation code via SMS: to continue, enter the code in question in the field Enter the OTP code and click on the button Continue.

Finally, you have to repeat the same procedure for theinformation relating to the Code regarding the protection of personal data anti-money laundering statement and l 'authorization to open the SEPA Direct Debit mandate to add funds to your wallet. Then take a look at all the documentation and accept it, typing yours first Password and then the verification code that you will receive via SMS in the appropriate text fields.

Portfolio Preview

We now come to the last stage of the Moneyfarm registration process: creating your own wallets.

The first step you need to take is to choose whether to ask Moneyfarm for advice or whether to proceed independently: in the first case, enter your telephone number in the appropriate text field, choose the day in which to be contacted and click on the button Confirm appointment; in the second case, instead, click on the button Continue in autonomy and go ahead with the procedure.

It indicates, therefore, how long do you plan to invest, choosing an option from Short term (1-2 years), Medium term (3-6 years) o Long term (7 years or more), and click the button Continue located at the bottom of the page.

You will then be shown the wallets which should be more suitable for you, with all the relevant statistics, the data on the historical performance and a projection on the expected return (with the possibility to modify the projection window, via the drop-down menu).

If the wallet illustrated by Moneyfarm satisfies you, use the drop-down menu at the bottom of the page to choose the type of investment to do between Wealth management (which automatically rebalances the wallet when needed) e Advice, reception and transmission of orders (which, on the other hand, gives advice on how to rebalance the wallet by requesting authorization to proceed) and click on the button Create wallets, I'll give you confirmation.

Alternatively, go back to the top of the page and select the tab relating to another wallet, to change the wallet to be created in Moneyfarm. Once this is done, click on the button Create wallets, to confirm and create the wallet.

As a last step, if you have set up an Accumulation Plan on your wallet, you must choose the day of the month in which you want the funds to be withdrawn from your bank account, using the appropriate drop-down menu and then clicking on the button Confirm the day.

The monthly recurring contribution will be automatically withdrawn from your bank account on the day you select and credited within 7 working days from that date.

If you want to set up an Accumulation Plan at a later time, remove your monthly contribution by clicking on the button Edit your wallet, down.

Mission accomplished! Now you just have to wait for the activation confirmation account (which will take a few days) and you can start using Moneyfarm.

How to use Moneyfarm

Once your account has been activated, you can start using Moneyfarm. Connect, therefore, to the home page of the service and log in to your account by clicking on the button Log in located at the top right and entering your credentials in the appropriate fields.

You will then access yours dashboards: a screen that allows you to monitor the recent activities (through the appropriate box in the left sidebar), the liquidity available and the trend of all wallets (with graphs showing its evolution from the beginning). Also, it contains gods helpful tips to use Moneyfarm, quick links to access the support and counters updated in real time with countervalue e amount invested.

To view the details of a particular wallets, click on the box relating to the latter and you will be redirected to a page with all the information of your interest: performance (with relative graph, customizable in terms of analyzed timing), countervalue and list of recent activities (with the possibility of filtering its contents, using the appropriate drop-down menu, located at the top).

Also, through the box asset location, you will be able to view data such as the risk level and percentages of items such as Short-term Government Cash and Bonds, Investment Grade Corporate Bonds, Bond Societari HY & Bond Gov. EM, Developed Countries Equity, Emerging Markets Equity, Materie Prime and Real Estate e Liquid assets. In short, everything is within reach!

Do you want to create a new wallet? Nothing simpler: go back to the Moneyfarm dashboardclick on your button New wallet and use the fields displayed on the screen to set your preferences.

Choose, therefore, theinvestment objective, using the appropriate drop-down menu, and type initial investment (minimo 5.000 euros) e monthly contribution (minimum 100 euros) in the appropriate fields. Then use the appropriate boxes to set a time horizon (short, medium or long term) and a risk level (low, medium or high) for the wallet. Finally, choose whether to invest with Wealth management (automatic rebalancing of the wallet) or with Advice and Receipt of Orders (tips for rebalancing the portfolio by requesting permission to proceed).

It also analyzes thewallet preview, carefully consulting the cards, graphs and percentages displayed in the center of the page and, when you are ready to confirm, click on the button Create the wallet, in order to create your new wallet.

Once you have created a wallet, you can add funds to it by simply clicking on the button Add funds by Moneyfarm.

On the page that opens, then indicate the wallet to which you want to add funds, selecting it from the drop-down menu Destination; establish the frequency with which to perform the addition of funds (whether individually or on a monthly basis); type theamount the investment you intend to make; choose the account of origin from which to withdraw the money and the payment method that you intend to use. Finally, click on the button Continue, to complete the procedure, and that's it.

If you prefer, know that you can also monitor and manage your investments from your smartphone, using the official Moneyfarm app for Android and iOS, whose operation follows almost everything on the website of the service.

If you need further information, you can consult the "How it works" section of the official Moneyfarm website, in which the operation of investments in Moneyfarm is illustrated in great detail, or you can consult the official guides and contact Moneyfarm support, how I will explain very shortly.

For more information

If you want more information about Moneyfarm and how it works, you can consult the Support section of the official website of the service, where you can find a series of answers to Frequent questions placed on a recurring basis by users. Also, by placing the mouse cursor on the tab Resources (above), you can access insights, guide, ebook and other contents that will surely help you plan a good investment and learn more about how Moneyfarm works.

How do you say? Do you need direct assistance from a Moneyfarm consultant? No problem: you can go back to the Support section of the official website of the service and book a telephone appointment. Alternatively, you can contact Moneyfarm directly on the toll-free number 800 984 275 (or, from abroad, to the number area code 02 4507 6621); you can send an email to [email protected]; use the service of Live Chat or contact Moneyfarm on Facebook Messenger and Twitter.

Through the Moneyfarm app for smartphones, however, you can contact support by pressing the icon comic located at the top right and selecting an item from Call us e Send us an email in the screen that opens. Alternatively, you can select the option FAQs to view frequently asked questions.

The opening hours of the Moneyfarm support are as follows: Monday to Thursday from 09.00 to 19.00, on Friday from 09.00 to 18.00.

Article created in collaboration with Moneyfarm.

Moneyfarm: what it is and how it works