Preliminary information

We will soon see, together, how InfoCert's Legalinvoice service works. But first, let me give you some general information on the electronic invoicing and its use.

Starting from 1 January 2019, electronic invoicing is mandatory for companies, sole proprietorships, freelancers and VAT numbers who are resident or have settled in the city. It concerns both the issuing and receiving of invoices from and to private individuals (B2B invoicing) and Public Administrations (B2G invoicing). Only those who operate on a flat-rate basis, minimum regime or advantage regime, amateur sports associations with revenues up to 65.000 euros per year, doctors and pharmacists who already have the obligation to transmit data to the TS system are exempt from the obligation. (health card), farmers with a special regime and those who sell goods or provide services to non-EU citizens and non-residents in the city.

With Legalinvoice by InfoCert it is possible to manage the entire billing phase concerning private individuals (B2B) and Public Administrations (B2G) by acting through a convenient Web panel, therefore directly from the browser (for example Chrome, Firefox o Safari) without installing any additional applications or plugins on your computer.

The issued invoices are sent to Exchange System (SDI) managed by the Revenue Agency - and therefore to the final recipients - by the expiry of the VAT settlement, so that customers who operate on a monthly basis can send invoices dated in January (on any date) by 15 February and customers who operate on a monthly basis quarterly can send them respecting the deadline of April 15.

To receive invoices, however, you must use the Recipient Code: an alphanumeric code consisting of 7 characters attributed by the Exchange System to subjects who have an accredited reception channel (such as InfoCert) and who, on behalf of the transferee / customer, receive the electronic invoice from the ES and sort it to the recipient the final. The InfoCert Recipient Code is XL13LG4 and, as well as communicated to suppliers, it must be registered with the Revenue Agency, in order to receive electronic invoices directly on your private panel.

As indicated in the standard, there is an obligation to digital storage of electronic invoices. The invoices are in fact accompanied by receipts for taking charge and acceptance of the Interchange System (SDI), which have legal value and must be kept together with the invoice. Legalinvoice also provides this function allowing the digital storage of both invoices and notifications relating to communications with the Exchange System.

Finally, a small note relating to hardware and software requirements necessary to use Legalinvoice. As it is, as already mentioned, a Web based service, Legalinvoice works on all major web browsers without the need for external plugins or special hardware requirements. Going into more detail, the browsers compatible with the service are the following.

- Chrome 15 and later.

- Firefox 15 and later.

- Safari 5 and later.

- Internet Explorer 10 and later.

- Opera 12 and later.

Not even a digital signature is required, as InfoCert is configured as a billing intermediary and signs the invoices with its own automatic-massive signature and sends them to the Exchange System (SDI) managed by the Revenue Agency.

Legalinvoice plans and pricing

Before getting to the heart of the tutorial and discovering, together, how to use InfoCert's Legalinvoice, it seems only right to show you the versions of the service available and the relative prices.

- Legalinvoice START - it is the ideal solution for artisans, traders, farmers and VAT numbers who currently produce invoices by hand or with Word or Excel, do not have a software or program for issuing invoices (management, accounting ERP, etc.) and yes they rely on an intermediary for accounting. It allows you to manage the entire billing process to and from the PA and private individuals (B2B). It offers functions for issuing invoices (with control, signature and automatic sending of electronic invoices to the SdI system of the Revenue Agency, with tracking of the results), estimates, DDT, schedule, control dashboard, verification, accounting and reception export functions invoices through an InfoCert accredited intermediary channel or through your own PEC InfoCert account. It also offers automatic storage and display in accordance with the law of active and passive B2B electronic invoices and PA invoices "Accepted" and "Deadline". You can try it for free for 6 months, after which it costs 4 euros / month + VAT (billed annually) and includes 200 invoices per year, sent or received via the Agenzia dell'Entrate's SdL Interchange System. Invoice storage and signature are included in the price. More info here.

- Legalinvoice PRO - it is the ideal solution for medium-sized businesses (businesses, companies, structured firms) which, although already in possession of a management or ERP software with which to create PDF invoices or already in XML-PA format, must make use of a specialized tool for B2B management, do not want or cannot modify their billing software and current workflows and / or have particular and sophisticated cases of electronic invoices to issue. It offers all the advantages of Legalinvoice START, plus the punctual and massive importation of PDF or XML invoices generated by ERP systems, a complete data upload, control and verification dashboard and a function for the massive export of data and invoices. You can try it for free for 6 months, after which it costs 7 euros / month + VAT (billed annually) but in the promo you can also pay half price. It includes 400 documents (invoices, credit notes, etc.) sent or received via the Interchange System (SdI) of the Agenzia dell'Entrate. More info here.

The Legalinvoice START and Legalinvoice PRO services are available in two variants: one for companies and VAT numbers and one for intermediaries (accountants, labor consultants, etc.) who can thus purchase utilities for themselves and their customers and privately share the data entered (invoices, credit notes and so on).

Furthermore, the availability of the promotion should be noted Starter Kit di Infocert, which includes PEC, electronic invoicing and electronic signature. More information on this is available on the official InfoCert website.

Please note: Legalinvoice provides for the replacement storage of invoices sent to the Public Administration through the system for a period of 10 years. In the event that you decide not to renew the subscription fee in the service, it is possible to download what has been sent in storage through the appropriate function available within the application before the end of the service.

How to activate Legalinvoice

Now that you know all the features of InfoCert's Legalinvoice, you can take action and activate the version of the service that you prefer the most. Connect, therefore, to the official website of Legalinvoice and choose whether to buy immediately a solution of your choice Legalinvoice START e Legalinvoice PRO or whether to activate one 6 months free trial.

If you prefer to try Legalinvoice START or PRO free for 6 months, click on the relevant item on the official website of the service and log in to your InfoCert account. If you don't have an account yet, click on the button Create an account and fill out the form that is proposed to you with yours email address and Password you want to use to log in.

Then check the box I'm not a robot and choose if give consent or not for marketing activities using the appropriate boxes located at the bottom of the page. Once this is done, click on the button Sign me up to move forward.

Adesso, premium pulsating Fill out the Activation Request and choose if activate Legalinvoice free for 6 months on the email address you indicated during registration or on another email address, typing it in the appropriate text field and pressing the button Attiva.

Once you have made your choice, fill in the form that is proposed to you with your personal data. Then use the drop-down menu Activities to indicate if you are a private, A 'firm, for an professional, you are part of the PA or are you a member of aAssociation, then provide the rest of the requested information: business name, tax code or VAT number, address, e-mail, cellular, name, surname and tax code of the applicant and so on.

Choose, at this point, if give consent for marketing activities using the appropriate boxes located at the bottom of the page and click on NEXT. Then specify theemail address where to receive the confirmation of the activation of the service and press the button NEXT per due turn consecutive.

Now you have to choose how to request the activation of Legalinvoice: via digital signature, using the program Dike (which I also told you about in my tutorial on how to open p7m files) or any other digital software or by printing, signing and sending the appropriate documentation by fax or certified mail.

In the first case, click on the button digital signature and follow the on-screen instructions. In the second, however, click on the button print twice in a row, print the PDF document that is provided to you, fill it in, sign it and then fax it to the number 06.89281226 or by PEC at [email protected]. Remember to attach one as well double-sided copy of the applicant's identity document.

Within three days of sending the contract, you should receive a message regarding the successful activation of Legalinvoice. Once you have received the confirmation email, click on verification link contained in it and fill out the form that is proposed to you with business name, fiscal Code, address and the rest of your business data. Finally, enter the password you want to use to access Legalinvoice and press the button Confirmation to confirm your identity and login to the service.

You have decided to buy directly Legalinvoice START o Legalinvoice PRO? In this case, connect to the official Legalinvoice website and click on the button Buy now related to the plan you have chosen. Then choose, from the appropriate drop-down menus, the duration of the subscription you want to subscribe (from 1 to 3 years) and the number of invoices you want to create and click on the button Add to Cart located at the bottom right.

On the next page, make sure your order summary is correct and click the button Proceed with payment. Then log in with yours account InfoCert by typing the credentials in the appropriate form or, if you do not have an account yet, click on the button Create an account to register (as explained above for the activation of the 6-month trial of the service).

Then follow the instructions on the screen to confirm your identity and complete the purchase of the service of your choice. Payment can be made via credit card, PayPal o Bank transfer.

How to use Legalinvoice

Once you have accessed InfoCert's Legalinvoice, all you have to do is connect to the home page of the service, log into your account and start managing your invoices. Now I'll explain everything to you in detail.

Please note: I used for the tutorial Legalinvoice START, which is the basic version of the service, therefore the following indications refer specifically to the latter.

Initial configuration

You are now on the Legalinvoice START home page, which contains a list of all latest activities carried out (e.g. receiving messages, inserting elements in the personal data, issuing or receiving documents and so on) and some toolbars, useful for reaching the various functions of the service.

La black bar at the top it allows you to quickly access the messages and management pages of your profile; there blue bar below includes a Campo di Ricerca for documents, customers etc. and icons for issue new documents (invoices, receipts, credit notes, etc.), view documents, log in instruments for managing the archive and sharing the work environment and receiving help in the use of Legalinvoice. On the left, however, there is a navigation menu which allows you to quickly access your own favorite features (e.g. issuing invoice, uploading files, sending messages, etc.), view thefiscal year in use, active shares, access the dashboards with the balance sheets of income and expenses, view the latest activities e import electronic documents.

As I will explain in this tutorial, it's all very intuitive. To begin, however, to issue and receive invoices with Legalinvoice START you must correctly complete the profile of your company and yours electronic profile: two operations that require only a few minutes of time but without which it is not possible to start managing your documents.

Also, I recommend that you adjust the settings related to the user profile (i.e. to your account on Legalinvoice) and al public profile that is displayed within the network of which the companies using Legalinvoice are part: follow the instructions below and you will be able to do everything without the slightest problem.

Company profile

To complete your company profile, click on the button vai which is located in the box displayed in the center of the screen and, consequently, fill out the form that is proposed to you with all the data of your company. If you do not see any box in the center of the screen, access the form with your company profile by clicking on theicona dell'ingranaggio located in the black bar (top right) and selecting the item Company profile give the menu check if you press.

Filling in the form is very intuitive: at the top there is the box Default logo where you have to insert your company logo (by uploading an image from your computer); in the section Tax data there are your personal data (the fields should already be filled in), while next to it is the button Add headquarters to enter data relating to the operational headquarters of the company.

Scrolling down the page, there is the section Data to be reported in documents in which you must enter, precisely, the data to be reported in the documents issued: name, last name, phone, e-mail etc. Once you have filled in all the fields, click on the button Save to save the information.

Now go to the left side menu, where you can find the links to access the other sections of the company profile: in Employment and business sector you can indicate your profession or the sector of your business (in order to allow the system to provide you with better suggestions and to help you set up your tax profile); in Document templates you can find the templates of invoices, packing slips, credit notes and other documents to view, modify and set as default (to set a template as default, click on theicona dell'ingranaggio located on its preview and choose the appropriate item from the menu that opens), while in Tax profiles you can set up your tax profile by clicking onicona dell'ingranaggio corresponding and selecting the option Imposta eat predefined from the menu that opens. It is all very simple.

Going up VAT codes you can manage the VAT codes: choose the default one for invoices or expenses and enter new ones (the default rate is 22%); in Terms of Payment you can manage the payment methods accepted (eg. check, transfer e credit card) and set new ones; in Numbering and counters you can manage the numbering of invoices (also choosing whether to activate or deactivate the automatic numbering mode and sectional management); in currencies you can set the reference currency for the invoices and the exchange rate, while in Email templates you can create templates for recurring email messages, such as those for invoice delivery, proforma sending, etc.

Finally, in the section Registry importer you can import personal data of customers / suppliers or products / services via CSV, XLS or XLSX files (just select the desired option from the appropriate drop-down menu and drag the file with the personal data) into the appropriate box that appears on the screen.

Electronic profile

The Legalinvoice START electronic profile contains the essential information to issue and receive electronic invoices. To complete it correctly, click on theicona dell'ingranaggio located in the black bar (top right) and select the item Electronic profile give the menu check if you press.

On the next page, select the entry B2B and PA electronic invoice master data from the left sidebar and fill out the form that is proposed to you with all your data: name / company name, address, VAT NUMBER, fiscal Code, type of taxable person, tax regime etc. Then enter the data of the contact person for the service (name and surname, telephone and email) and click on the button Save (bottom right) to save the information.

A message displayed at the top of the page will notify you when the electronic document transmission and reception service is active for your account. This typically takes no more than 10 minutes.

Successively select the voice B2B and PA e-invoice profile settings from the left sidebar to access the section where you can set the standard to be used for electronic invoicing: Invoice PA to have as standard the issue of invoices and electronic documents to Public Administrations or

B2B invoice to have as standard the issue of invoices and electronic documents to all subjects other than Public Administrations. Select, therefore, the default interchange format between B2B invoice e Invoice PA from the drop-down menu, specify the default values to use for VAT collectability (immediate due date or split of payments) e causal payment and click sul bottone Save (bottom right) to save the changes.

Per finire, select the voice Electronic invoice B2B and PA receiving channel settings to view the Intermediary Code to be communicated to suppliers (and entered on the Revenue Agency website) to receive electronic invoices.

User profile

As already mentioned above, the section User profile of Legalinvoice START is the one that includes all information relating to your account on the service. To access it and thus change the information relating to your account, click on theicona dell'ingranaggio located in the black bar (top right) and select the item User profile give the menu check if you press.

On the next page, select the entry User from the left side menu to edit name, last name, Password e contact info for Legalinvoice START or voice Localization parameters to adjust the settings related to language, time zone, date format etc.

Going instead to the section Account email e clicking on your button Add email account you can activate LegalInvoice START's internal mail system and configure your mail account via SMTP to send messages directly from the service.

Finally, by accessing the section Automatic reminders you can adjust the parameters for the automatic sending of payment reminders while going on First page you can adjust the contents to be shown on the LegalInvoice START home page: latest activities with the latest activities related to your account or Dashboard with the balance sheets of income and expenses. In all sections, to save your preferences and save the changes made, press the button Save located at the bottom right.

Public profile

Legalinvoice START also includes a "social" component, in fact the companies that use the service are part of a network that allows them to easily relate to each other and, by default, have a public profile.

To adjust your public profile settings on Legalinvoice START, click onicona dell'ingranaggio located in the black bar (top right) and select the item Public profile from the menu that opens. On the next page, by placing or removing the check mark from the available boxes, choose whether allow the publication and searchability of your public profile, allow the anonymous sharing of non-sensitive information, allow the viewing of other users who have authorized the viewing of their public profile and more. To save your preferences, click on the button Save located at the bottom right.

Once you have adjusted the privacy preferences of your public profile, if you have decided to keep it active, select the item Public data from the left sidebar and choose which data to share with network participants (addresses, contacts, current account, etc.), then press the button Save per salvare I modified it.

At this point, move to the section Public page color and background (still in the left sidebar) and set a background for your public page. Once this is done, click on the button Save to save your preferences and move to the sections External web pages e Image gallery to set, respectively, the social links to show on your public page (Facebook, Twitter, LinkedIn, YouTube etc.) and the images to show in your gallery. Also in these cases, to save the settings, click on the button Save located at the bottom right.

Issue of documents

Issue a new document in Legalinvoice START is very simple. For example, all you need to do for issue an invoice is to click on the button New located at the top right (the sheet icon) and select the item Invoice from the menu Issue that appears. The first time you access this feature, you will be offered a short tutorial in which you will be explained in a simple way how to fill out invoices. You can then get tips on filling out the documents by clicking on the buttons [?] placed in correspondence with the various fields to be filled in.

Once the form to be filled out is displayed, select the document format to create (B2B invoice o Invoice PA) and the currency to be used from the appropriate drop-down menus. Then fill in the fields document number e accounting date with, respectively, the invoice number and its issue date.

Then move to the section Administrative address and enter the customer's data: Legalinvoice START will suggest some names already available among those present in the network. For names already present in the network or in the registry, simply select the name to automatically fill in the rest of the data. If you want to add a destination address, as the invoice must be sent to an operating office other than the recipient's registered office, click on the appropriate button and fill out the form that is proposed to you.

Fatto ciò, click on your button Add detail and enter the description of your invoice using the form that appears on the screen: then choose a card among Product / service, expenditure e Fuel, type the Description of the product / service provided in the appropriate text field and enter price, amount, unit, discount, IVA to apply and preferences ontaxable in the respective boxes and menus. The field Code it is optional and can be filled in automatically using suggestions from the Legalinvoice START network.

Once you have entered all the information, click on the button Confirmation which is on the right and repeat the procedure for all the products / services you want to include on the invoice. Legalinvoice START will learn all the information entered for subsequent times.

At this point, you can move on to the section Tax parameters, in which the tax profile to be used must be indicated. As you well know, there are different ways to make the counts of a document, which depend on the different types of tax profiles present. To select your tax profile, expand the drop-down menu Tax parameters and select from the latter the most suitable option for you (e.g. Invoice Standard VAT regime, Invoice Company flat rate scheme o Invoice Minimum Company Scheme).

If you do not know which is the most suitable tax profile for you, check the total of the accounts that appears in the invoice compilation screen and compare it with that of a previous document. Alternatively, try to send the invoice produced in Legalinvoice START to your consultant and ask him for information. If among the tax profiles available in Legalinvoice START there is not one suitable for you, you can create one by going to the menu Company profile (as I explained to you before) and selecting the item Tax profiles from the side bar of the sinistra.

After selecting the tax profile, indicate thechargeability of VAT (immediate, deferred or split payments) and the currency and exchange rate (if necessary) through the appropriate drop-down menus.

The next step is to fill in the fields on terms and payment information. In Payment terms description you must enter a brief description of the payment terms; in the drop-down menu End Date you must indicate the method of expiry of the document (eg. specific date, month (s) o year / s), while using the menu Paid you must indicate if the invoice is to pay o already paid.

Once you have entered all the information, click on the button Define payment plan, check that the data entered are correct and click on the button √ to save. For some methods of expiration it is possible to obtain an automatic calculation of the payment date based on the number of days, months or years entered.

Once this is done, go to the fields below where you can indicate yours Bank account details: bank name and IBAN. If you want to enter more details, click on the appropriate button and fill out the form that is proposed to you. The information entered will be reported in the document to facilitate payment operations to the recipient.

Once you have filled in the fields relating to bank details, you are practically ready to finalize your invoice. Therefore, use the drop-down menu Document template to use (bottom right) to choose the PDF template to use for your invoice (you can view a preview by clicking on theeye), choose whether to add information related to receipts, notes o attachments to the document (by expanding and then filling in the appropriate fields) and click on the button Save to save the document.

Once you have created your invoice, you are ready to send it to Exchange System of the Revenue Agency (SdI) and then to the recipient. To proceed, click on the button Show located at the top right (the icon with the 6 sheets) and select the item Invoices from the menu Documents issued that appears on the screen.

At this point, locate the invoice to be sent, click onicona dell'ingranaggio mail in his correspondence, select the item Electronic transmission from the menu that appears and answer Yes to the message that is shown to you. You can then follow the status of the shipment by clicking onicona dell'ingranaggio mail in correspondence with the invoice sent and selecting the item Preview give the menu check if you press.

In the same menu there are also options for visualize the document, download on the PC, send it by email, send a payment reminder to the client, create a credit note, copy the invoice, display theaccount balance ed eliminate the document: it's all just a click away.

The procedure for issuing new invoices can be replicated to also issue all other types of documents supported by Legalinvoice START.

In fact, by clicking on the button New located at the top right (the sheet icon) and selecting one of the options in the menu Issue that appears on the screen you can start creating a new one receipt, a Credit note, for an proforma, for an transport document or quote.

The forms you need to fill out for creating such documents are very similar to those shown above for invoices, so you won't find any difficulty in using them.

Anyway, I remind you that clicking on the buttons [?] placed next to each field to be filled in, you will receive information and suggestions on how to fill in the various forms correctly.

Receipt and registration of documents

receive electronic invoices on Legalinvoice START you just need to complete your electronic profile and wait for the service activation message for sending and receiving invoices, as already explained previously in this tutorial. Once activated, you will receive the Recipient Code (XL13LG4) to be communicated to its suppliers or registered on the Invoices and Payments service of the Revenue Agency, in order to receive all the invoices at the electronic address set on the latter.

The passive invoices automatically received on Legalinvoice START are available in the section Received Documents> Invoices of the service, which is accessible by clicking on the icon Show located at the top right (the one represented by the icon with the 6 sheets). Once displayed, the documents can be filtered according to various criteria, for example the month of issue or the status (expired / not expired, paid / unpaid): just click on the button filters located at the top right and choose the parameters to be used from the box that appears at the top.

By clicking on theicona dell'ingranaggio placed next to each invoice, it is possible to preview it, copy it, view the statement of account, mark the document as seen, delete it and more. It should be noted that the automatic delivery of passive invoices also includes a daily notification via email and that, if the documents received contain deadlines, after the visa operation, these are automatically inserted in the legalinvoice START passive schedule.

Via the menu Show of the service, moreover, it is possible to access the credit notes, To documents awaiting inspection, incoming notes and at expense reports. The section Documents awaiting inspection has only an organizational purpose and allows you to view the documents received, view them, download them and possibly view them to allow your tax consultant to know that they are fine and can be processed for accounting purposes. It is important to emphasize that it is not possible to reject the B2B invoices received: in case of errors or problems, it is only possible to contact the supplier and request the issuance of a credit note.

The sections dedicated to notes in revenue and at expense reports, on the other hand, they should be used to annotate first-note findings that can be useful to have in Legalinvoice START for uniqueness in managing your documentation.

Documents that are not passively forwarded to Legalinvoice START can be added "manually" to the service through the operations of registration e importing an electronic document provided by the service.

To register a Fattura, a Credit note, a entry note, a shopping list or transfer, all you have to do is click on the icon New of Legalinvoice START (the sheet icon located at the top right) and choose the type of document to be registered from the menu Registration that appears on the screen.

Then fill out the form that is proposed to you by entering all the necessary data (the compilation is almost identical to what was seen in the chapter of the tutorial dedicated to issuing invoices) and save all by pressing the appropriate button located at the bottom right.

In the event that you have an electronic document issued by you or your suppliers and want to import it into Legalinvoice START, instead, you must select the item Import electronic document from the menu New (the sheet icon located at the top right) and drag the file to the appropriate box.

You can upload electronic invoices, credit memos, and any other supported document types issued by you or your suppliers. At the end of the transfer, the imported documents will be added to your desk and you will be able to manage them like any other document produced with Legalinvoice START, but you will not be able to modify the data contained within them (except for information regarding receipts / payments and internal notes ).

Personal data management

Legalinvoice START makes the management of personal data. By accessing the section New (the sheet icon located at the top right) and selecting an item from the menu Personal data that appears on the screen, you can in fact insert a new element in the personal data of customer / supplier, product / service e bank / account, so you can recall customers, suppliers, products, services and bank accounts in your documents automatically, without having to enter their data every time.

After selecting the type of item to add in the personal data, then fill out the form that is proposed to you with all its data. In the case of customers and suppliers, for example, you must enter information relating tobilling address (name and address), i accounting data (VAT number, tax code, PEC etc.) and, if available, the data relating to contacts e bank / account. Then, via the drop-down menu Send payment reminders, you can choose whether or not to activate the sending of automatic reminders for the selected customer or supplier. At the end of the compilation, click on the button Save (bottom right) to save the item in the registry.

Once entered in the registry, all the elements added to the Legalinvoice START database can be consulted and modified by going to the menu Show (the icon with the 6 sheets placed) and selecting one of the options available in the menu registries that appears on the screen: Customers / Suppliers, Products / Services o Banks / accounts. Also, they can be searched using the search box placed at the top center.

Once you have entered the personal data management menu, you can filter the elements present in it by clicking on the button filters located at the top right and choosing one of the options available in the box that appears on the screen (e.g. the alphabetical arrangement A> Z or that Z>A). Also, I point out that by selecting elements and clicking on the button Export (top left), you can export these as a zip file. To edit an element, instead, click on it. To delete it, click on theicona dell'ingranaggio mail in its correspondence and select the appropriate item from the menu that opens.

If you need it, you can also import existing personal data in the form of CSV, XLS or XLSX files by going to the menu Company profile and selecting the voice Registry importer from the side bar of the sinistra.

Summary and archive

Two other very useful functions of Legalinvoice START are those related to summary andarchive. Thanks to the summary it is possible to have a general overview of first note, schedule (with the deadlines of the documents issued and received, automatically added by the system), recurring documents, inputs outputs (with annual and monthly balance sheets and graphs), cash flow e IVA. To access all this information, click on the button Show (the icon with the 6 sheets located at the top right) and choose one of the options available in the menu Riepilogo that appears on the screen.

In 'archiveinstead, the documents that the system has generated following procedural extractions (ie through the “Export” function) or that have been uploaded by the user through the upload function are stored. To view the documents in the archive, click on the button Instruments located at the top right (the icon depicting the screwdriver and wrench) and select the option Documents from the menu archive that appears on the screen.

On the page that opens, you can view the documents in the archive and upload new ones by dragging them to the appropriate box or clicking on the button Select a file or drag it here to upload.

In the menu archive of Legalinvoice START function is also available Export, through which it is possible to export the documents and data present in your desk. To use it, select the type of data to export (Customers / suppliers, Products / services, customer / supplier movements by spesometer, spesometro o BPoint WKI) from the drop-down menu What to export, type il name you want to assign to the file in the appropriate text field and press the button Export located at the bottom right.

When your archive is ready, you will receive an e-mail message containing the link to download it to your computer. Simple, right?

Sharing the work environment

You would like it share your work environment on Legalinvoice START with a colleague or with your accountant? No problem: if the person in question is part of the START network, you can do it very easily.

To proceed, search for the nominative of the person with whom you wish to share the environment in box located in the top center, locate the user on the page with the results, click on theicona dell'ingranaggio mail in his correspondence and select the item Manage permissions give the menu to compare.

In the box that is shown to you in the center of the screen, then select the item Qualified give menu to tendin Environment sharing and click on the button Save to confirm.

Subsequently, you can view and manage the users with whom you have shared your environment (and view the list of users who have possibly shared their environment with you) by clicking on the icon Instruments (top right) and selecting the item Environment sharing give the menu to compare your schermo.

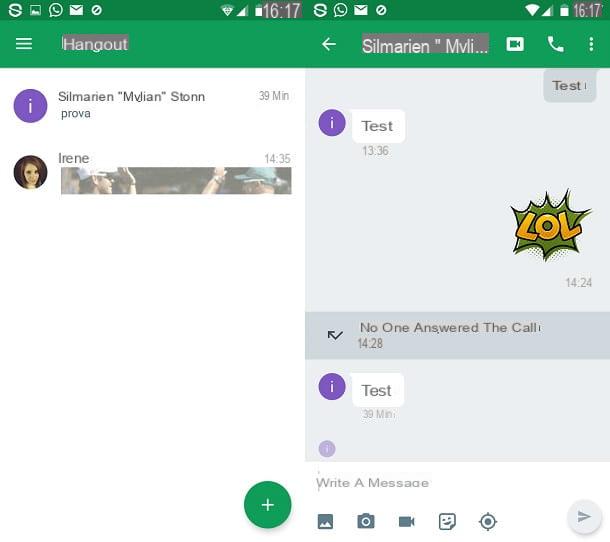

Access from smartphones and tablets

If you were wondering, Legalinvoice START is also accessible from smartphones and tablets. All you have to do is open the browser you usually use to browse online on your device (eg. Chrome your android or Safari on iOS), connect to the main page of the service and log in to your account.

Once logged in, you will find yourself in the presence of the classic Legalinvoice START interface, which can also be used without problems from mobile: the operation of the application is in fact identical to what was seen previously for its desktop variant.

Legalinvoice support

If you still have any doubts about the functioning of Legalinvoice, you can connect to the Customer Assistance page of the InfoCert website, where the answers to the Frequent questions posted by users of the service. To access the full list of questions (and their answers), click on the entry Read all the questions about Electronic Invoicing >> located at the bottom of the section FAQ.

Another useful resource, which I highly recommend you to consult, is the Legalinvoice START user manual, accessible by clicking on the button first Instruments located at the top right (the one with the icon representing a screwdriver and a wrench) and then on the item User Manual, in the menu that opens.

If, on the other hand, you need to contact InfoCert support directly, connect to this web page and choose one of the three available options: Write to us on the online form to open a discussion on the InfoCert support forum and wait for a response from the staff; Chat with an operator to speak in live chat with an operator (available from Monday to Friday, excluding holidays, from 8.30 to 19.00) or Call 06.54641489, to contact InfoCert support by telephone (the service is available from Monday to Friday, excluding holidays, from 8.30 to 19.00).

And if you need dedicated support, you can click on the button Buy now and purchase the advice of a qualified consultant by telephone. More info here.

Article created in collaboration with InfoCert.

How InfoCert Legalinvoice works