Enel X Pay: costs and plans

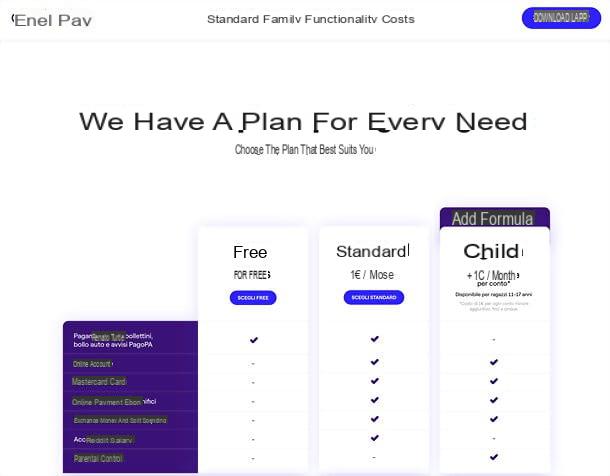

Before getting to the heart of the guide and explaining yourself how Enel X Pay works down to the smallest detail, it seems only right to make an overview of plans and pricing of the service: here they are listed below.

- Free (free) - is the basic plan of Enel X Pay. It includes the payment of bills, car tax and PagoPA notices (with a commission of 2 euros).

- Standard (1 euro / month) - includes the online account, the free virtual and physical Mastercard card (in bioplastic, with high respect for the environment), the possibility of making payments both online and in physical stores, the payment of wire transfers, the exchange of money, the division expenses with other people, the possibility of crediting salaries, donations to non-profit organizations, parental control functions and the payment of bills, car tax and PagoPA notices (with a commission of 0,50 euros / operation, except for Enel bills Energy that are free). It also allows you to receive SMS notifications for payments (0,1 euro / SMS), make and receive SEPA and extra SEPA transfers (free), perform operations in foreign currencies (with the exchange rate used by the Mastercard circuit) and make withdrawals at the ATMs of the affiliated banks in the city and in the EEA states (0,50 euros / operation) and non-EEA states (2% of the sum withdrawn). The stamp duty is 2 euros if the balance at the end of the period (31 December) is greater than 77,47 euros; the annual top-up limit is 100.000 euros; the spending limit is 500 euros per day (or per single item) and 3.000 euros per month, the withdrawal limit is also 500 euros per day and 3.000 euros per month. Apple Pay and Google Pay support included.

- Family (+1 euro / month per account) - Enel X Pay allows you to activate an account for your children aged 11 to 17, with dedicated cards and apps that can be controlled with parental controls, in order to monitor and block their activity from the app. The accounts for the children have all the advantages of the Standard ones, except the possibility of paying bills, car tax and PagoPA notices and sending / receiving wire transfers. In addition, the maximum expenditure and withdrawal is 500 euros in total.

To find out more, I invite you to consult the Enel X Pay website, where you can find a comparative table with all the available plans and the information sheet with all the economic conditions.

Enel X Pay also offers the possibility to participate in the State Cashback and Super Cashback and in the Receipt Lottery without SPID and without the IO app. For more information on this, consult my guide dedicated to the topic and the Enel X Pay website.

How to open an Enel X Pay account

Having made the necessary premises relating to plans and prices, the time has come to see concretely how to open an Enel X Pay account. I assure you that it is really very simple!

To open an Enel X Pay account and start sending / receiving money with it, you need to install the service app on your smartphone. The application is compatible with both Android (requires Android 6 or later) that with iOS / iPadOS (requires iOS 12 or later).

To get it, open the store of your device (Play Store on Android or App Store on iOS / iPadOS), search for it within the latter and select its icon from the search results. Alternatively, if you want to do this first, visit one of the links I just provided you directly from your device, in order to open the store page dedicated to Enel X Pay.

Per concludere, premium pulsating Installa / Ottieni and, if you are using an Apple device, verify your identity via Face ID, touch ID o Password, to start the automatic download and installation of the application.

Once the app is installed on your smartphone, you are ready for open your Enel X Pay account in complete autonomy. All you need are a few minutes of free time, an Internet connection and valid identification documents.

To begin with, start the official application of Enel X Pay, award-winning Log in and follow the short initial tutorial. Once this is done, click on the tab Subscribe and fill out the form that is proposed to you with name, last name e fiscal Code; then press the button to go forward.

You will be offered another form to fill out, this time with telephone number, email address e Password to use to access the service: enter all the requested information and go forwardby pressing the appropriate button.

The next step is to check the boxes related to condizioni e privacy disclaimer (the others are optional) and in verifying the telephone number entered, by entering a code of confirmation which will be sent to you via SMS. Once you have entered the code received via SMS, you will need to log in to yours e-mail box and click on confirmation link contained in the email sent by Enel X Pay (which is used to verify the authenticity of the address you entered previously).

Also verified the email address, click on the link for open the Enel X Pay app, choose whether to authorize access to it via biometric recognition (fingerprint or face) and press the button Open account to start the actual account opening procedure.

You will be shown a screen with the summary of what you need to proceed: make sure you have everything at hand and tap the button Continue; then choose the document to be used for the recognition between Paper identity card, Electronic identity card, Passport e Patent and take one photo before the front and then the back of the document using the camera of your smartphone: make sure to match the document with the template on the screen and, after shooting, confirm that the photo is visible, otherwise take another shot.

After having photographed one or more documents (eg. Electronic identity card and social security number), according to the instructions received from the app, you must create a selfie video to verify your identity. Then press the button let's start, frame your face in the shape that appears on the smartphone screen and execute i movements that are indicated to you (e.g. turn your head or close your eyes; a vibration will confirm the correct execution of the movement).

Once the selfie video has been made, you have to fill in the forms that are proposed to you, relating to document data that you have photographed previously, to yours personal data (name, date and country of birth etc.) and al Your address of residence. You will then be asked questions about yours profession, your degree of political exposure and yours income: answer everything and go forward.

Finally, you have to request the digital signature certificate, carefully consult the whole documentation that is submitted to you, accept it, check the boxes relating to clauses and digitally sign the account contract by entering the verification code you receive via SMS.

At the end of the procedure, the verification of your data will start and, if everything is in order, within a few hours you will be notified about the activation of your Enel X Pay account.

How to use Enel X Pay

Once you have received the notification relating to the activation of the account, you are ready to make and receive payments with Enel X Pay and access all the other possibilities offered by the app. That's how.

Top up Enel X Pay

First of all, to use the Enel X Pay account it is necessary perform a recharge of at least 10 €: you can top up your account in real time using another card (even not in your name), or you can make a transfer to your Enel X Pay account and wait for the technical time necessary for credit (a kind 1-2 working days).

To proceed with the top-up by card, answer in the affirmative to the notice that appears at the first access to the app and follow the presentation of the paper that is shown to you on the screen (the card is initially only virtual, but you can request it in a physical version in a very simple way, as you will find explained later in this guide).

If you do not see the top-up request from the app or you skipped it by mistake, don't worry, you can top up Enel X Pay by card at any time by clicking on the item Top up card present in the main screen of the application (the icon of the cottage in the menu below) or in the paper management panel (the icon of the paper present in the menu below).

At this point, fai tap sulla voce Link card, choose whether or not to store the data of the card you are going to use for recharging (so as not to have to rewrite them for subsequent recharges) and type theamount to top up in the appropriate field that appears on the screen (or select one of the suggested cuts between 20€, 50€, 100€ o 200€). The minimum top-up amount is 10 euros.

Fatto ciò, first prize Confirmation, enter the details of the card you want to use to top up Enel X Pay, check the box relating to Privacy Act and press pulsating Confirmation, to initiate the transaction.

If you prefer to top up Enel X Pay via transfer, you can view theIBAN of your account by accessing the card management panel (the icon of the paper present in the menu below) and pressing the appropriate button. By tapping on the voice instead Banking details a screen will open with name, IBAN, BIC e SWIFT account, to be copied and shared to make the transfer. You can make wire transfers from any institution and account, even in the name of people other than the holder of the Enel X Pay account.

Apply for and manage your card

As already mentioned, the standard Enel X Pay account includes one Mastercard letter virtual that can be used to make purchases both online and in physical stores (also having the possibility to take advantage of the State Cashback and payment systems via smartphone and smartwatch, such as Google Pay and Apple Pay). However, it is also possible to request one physical paper in bioplastic (therefore with the utmost respect for the environment) to be received at home completely free of charge.

To request your physical card, all you have to do is access the card management panel in the Enel X Pay app (the icon of the paper in the menu below), press on the item ask for physical card, read the information displayed on the screen (i.e. the general presentation of the bioplastic paper), go forward and verify that the information contained in the form proposed to you (i.e. the card shipping details) is correct.

Finally, hit the button Confirm order and you will receive your card at home in a few days. The card will then be activated by entering, in the section Activate physical card of the app, the code present in the documentation attached to it (precisely under the card).

Keep in mind that by requesting the physical card, the code CVC and Expiration date the latter will also be adopted by the virtual card; therefore if you had already registered the latter on sites and online stores, you will have to change the data in question.

Another thing to know is that the first time you use the physical card in the store you will have to physically insert it into the POS and insert the relative PIN to make the payment; from subsequent times you can then use the contactless system without the need to insert the card in the POS.

To manage the card associated with your account, be it physical or virtual only, you can access the specific section of the Enel X Pay app (the icon of the paper present in the menu below), where by selecting the item Card security You can temporarily block o block for suspected fraud the paper by pressing on the appropriate levers.

Family of Enel X Pay

Through the card management screen in the Enel X Pay app, you can also request cards for your children and thus take advantage of Family of Enel X Pay. As already mentioned in the opening words of the guide, with the Enel X Pay Family function you can open an account for your children aged 11 to 17 (up to a maximum of five) and give them both a virtual and physical card to use for purchases. in physical and online stores, for withdrawals and to exchange money with other Enel X Pay users.

You can manage everything via parental control from the app, having the ability to monitor and block their activities, view the balance of the cards, make one-shot or periodic top-ups and decide which product categories your kids can buy. All for 1 euro / month for each card requested.

To request a card for your children, all you have to do is go to the section of the Enel X Pay app dedicated to carte (l'icona della paper present in the menu below) and press on the item Become Family. On the next screen, tap the button Continue, choose the color of the bioplastic paper to request, enter email address e cellphone number of the minor to whom you wish to make the card, go forward and choose a document to use for identification between paper identity card, electronic identity card e passport.

The procedure for identifying and applying for the card is very simple: it will be enough for you photograph the selected document and follow the rest of the on-screen instructions. Everything happens in a fairly similar way to what was seen for the main procedure for opening an Enel X Pay account. You will then receive the cards for your kids directly at home and you will have to activate them by always acting as an app. More info here.

Make purchases and payments with Enel X Pay

With Enel X Pay you can make purchases both online and in physical stores with extreme simplicity. To purchase goods and services online you can simply select the paper as a payment method on the site or app on which you are making purchases and enter the details of the card associated with your Enel X Pay account.

You can find your card number by going to the specific section of the Enel X Pay application (the icon of the paper in the menu below) and pressing on the graphic representation of the card itself; to view CVC e Expiration date, award-winning Wheel placed at the bottom.

As for the purchase in physical stores, however, you can use Google Pay or Apple Pay or you can request the physical letter and pay normally with the POS (also in contactless, after making the first transaction by physically inserting the card into the POS).

Enel X Pay then allows you to make payments of various kinds, including free SEPA transfers, bills, car tax, MAV, AMBER e avvisi PagoPa, all in a few moments for only 0,50 euros (if you open the Standard account). In addition, Enel Energia bulletins are free of commissions!

To make one of the payments in question, all you have to do is go to the appropriate section of the Enel X Pay app (the icon of the hand and coin located in the menu below), select the option you are interested in and follow the instructions on the screen.

For example, for bank transfers you just need to enter the recipient's data (which can also be selected from the address book), IBAN, amount and reason, while for bulletins you just need to select the type of bulletin to pay (eg. premarcato 896, MAV o AMBER), scan the QR and confirm the payment. More info here.

All expenses made with Enel X Pay are shown - together with income - in the summary graph on the Home screen of the app (the icon of the cottage in the menu below), while in the section dedicated to statistics (l'icona del graphic in the menu below) you can find detailed charts for revenue e outputs with movements automatically divided into categories.

Pressing on each graph you can view the complete list of movements for the current month and total movements. In this way, you will be able to view everything in a more orderly way and consciously manage expenses to make better choices for your future. More info here.

Exchanging money and sharing expenses with Enel X Pay

Enel X Pay includes a immediate and free P2P payment system, through which it is possible to easily exchange money with other users of the service (and invite those who do not yet have an account to open it).

To take advantage of this possibility, go to the section Payments Enel X Pay app (the icon of the hand with coin in the bottom menu) and select the item Exchange money from the latter. On the next screen, select the contact with which to exchange money, you choose if send o require a sum to the latter, type theamount it's a message accompanying and prizes Send, to submit the payment or request for payment. More info here.

Equally simple it is share the expenses with friends and family who use Enel X Pay. To split a purchase you've made with other people, select the transaction from the screen Home or section Stats of the Enel X Pay app, tap on the item Divide spending, select the people with whom to divide the expense, type a message accompanying and press the button Divide spending, in order to forward your request. More info here.

Donating with Enel X Pay

Enel X Pay also offers the possibility of making a concrete contribution to the work of various non-profit organizations, such as Save The Children e Food For Soul (currently only on Android) with donations to be made directly from the app.

To make your contribution to one of the supported initiatives, go to the screen Payments of Enel X Pay (the icon of the hand with coin in the bottom menu), press the button for to donate and select one Onlus among those available.

Read, therefore, the information available on the work of the selected non-profit organization; if you want, deepen it by choosing to visit the website organization and, if you deem it appropriate, make your donation by clicking on the button Donate now.

State cashback with Enel X Pay

Enel X Pay also offers the possibility to participate in the State Cashback, the Super Cashback and the Receipt Lottery without SPID and without using the IO app.

To take advantage of this possibility, open the app of Enel X Pay, tap on the icon two horizontal lines present in the menu below and tap on the item Cashback program. Then press the button Activate program, select the paper to be connected to the cashback, tap the button Fellow worker and indicates whether to receive the State Cashback (and possibly Super Cashback) on theIBAN by Enel X Pay.

That's all! Now you can make payments in physical stores with Enel X Pay and get the State Cashback according to the rules set out in the initiative. For more information, I recommend that you consult my guide on how to obtain State Cashback without SPID with Enel X Pay and the Enel X Pay website.

Other useful features

Now you should have a fairly clear idea of the main features of Enel X Pay, but there are also many other possibilities offered by this service (which are destined to grow steadily over time).

For example, I point out that pressing the icon of two horizontal lines present in the menu below you can access partner services, such as Euclidea (to grow your assets with a management that selects the best ETFs and funds for you) e Yolo (temporary insurance for every need), you can use discount codes to take advantage of various promotions and you can invite your friends in Enel X Pay.

By pressing, instead, on the icon of thelittle man located at the top right you can access your personal menu, through which you can view and edit the your data and yours Password, view contract and consents, manage notifications, enable authentication via footprint / face (on devices that support these technologies), choose whether make yourself visible to contacts on Enel X Pay and access the Support (which I will tell you about in more detail in the next chapter).

For more information

If you need to more information on Enel X Pay, you can consult the FAQ section of the official website, which contains the answers to the most frequently asked questions by users.

Alternatively, if you are already an Enel X Pay customer and need help, you can access the section Support of the app (via the icon of thelittle man which you find at the top right) and send a message toassistanceby selecting one Thematic from the appropriate screen and then writing your request in the text field; or you can initiate a call, using the icon of the handset at the top right.

If you are not yet an Enel X Pay customer, you can contact support by phone at the toll-free number 800.993.339, or you can send an email to [email protected].

Article produced in collaboration with Enel X Pay.

Enel X Pay: what it is and how it works